Wow, there it was in black and white!

It was a press release from the Ontario Minister of Energy, Todd Smith asking (nay, telling) the Ontario Energy Board “to explore options for an Electric Vehicle Charger Discount Electricity Rate as the province continues to support the adoption of electric vehicles (EV).”

Needless to say the press release goes on and on to glorify EV reminding one of old expressions such as putting “lipstick on a pig” believing it will change our beliefs and the lipstick will change our view of the pig from “ugly to pretty”!

A couple of examples follow from the press release:

1.”A new electricity rate would support electric vehicle adoption across the province by reducing the electricity costs for charging infrastructure where demand is only beginning to emerge, making them more economical.”

Presumably what the foregoing implies is that cheaper fuel costs (charging your EV) will entice more Ontarians to purchase an EV! On the other side of the road if you own or purchase an ICE vehicle you will be hammered by added costs which now include that “carbon tax” which will continue to add to those fuel costs as it increases year over year!

What is missing in the advent to “cheaper fuel costs”; implied by conversion to an EV, here in Ontariowe are many facts and costs associated with the electricity sector including:

a) increasing your home service from a 100-amp to 200 amp service, b) the electricity service on your street may require an upgrade, c) the local transformer station may also require an upgrade should EV ownership increase substantially d) lots more generation will be needed to satisfy demand. All of the foregoing will add to the costs of electricity which will impact all households and businesses either by increased electricity rates or even more than the current $7.3 billion will need to be absorbed by taxpayers.

2.“With $43 billion in new electric vehicle and EV battery manufacturing investments in Ontario’s auto sector over the last several years, our government is working to improve access to public charging infrastructure to support drivers who are making the transition to electric vehicles.”

If one follows the news and has read the November 17, 2023 press release from the PBO (Parliament Budget Office) it is interesting to note it estimated “government support” for just the battery manufacturing sector amounts to $43.6 billion which is remarkably close to what the Ontario government claims is being invested in Ontario’s auto sector.

The PBO goes on to state “We estimate the total cost of government support for EV battery manufacturing by Northvolt, Volkswagen and Stellantis-LGES to be $43.6 billion over 2022-23 to 2032-33, which is $5.8 billion higher than the $37.7 billion in announced costs,” adds Mr. Giroux. The $5.8 billion in non-announced costs represents foregone corporate income tax revenues for the federal, Ontario and Quebec governments combined.

Of the $43.6 billion in total cost, PBO estimates that $26.9 billion (62 per cent) in costs will be incurred by the federal government and $16.7 billion (38 per cent) will fall on the provincial governments of Ontario and Quebec.”

What the PBO report notes is that not only are we Canadian and Ontario taxpayers providing huge subsidies for those investments but at the same time we are granting them tax free status.

The PBO press release goes on to specify “Of the $43.6 billion in total cost, PBO estimates that $26.9 billion (62 per cent) in costs will be incurred by the federal government and $16.7 billion (38 per cent) will fall on the provincial governments of Ontario and Quebec.“ The PBO goes on stating; “We estimate a break-even timeline of 15 years for the $13.2 billion production subsidy announced for Volkswagen, and 23 years for the $15.0 billion in production subsidies announced for Stellantis-LGES—consistent with our previous estimate of 20 years based on their combined production schedules”.

The foregoing suggests our current Federal and Provincial governments contain politicians we elected to see into the future!

Based on the incredible commitments being made here in Ontario and the obvious push to capture EV manufacturing we Ontarians should wonder what is the uptake of BEV and Hybrids (including plugins) when compared to ICE and Diesel sales?

Are We Buying What Politicians Are Selling?

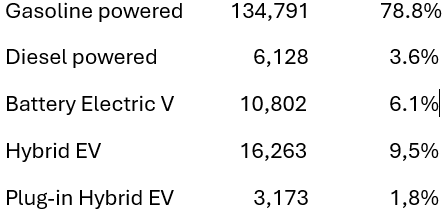

A quick review of StatsCan vehicle registrations in Ontario* for the 2023 fourth quarter disclosed there were 171,157 vehicle registrations in the province in total. The registrations break down as follows:

Conclusion

It sure appears Ontarians are not sold on the purchase of BEV whereas gasoline hybrids are much more popular but even those didn’t achieve a 10% market share. The BEV market share has not bloomed suggesting the $43 billion of taxpayer dollars handed to the auto companies are not inspiring people to purchase them.

It is looking more and more like our politicians; with blinkered foresight, don’t have an appreciation of taxpayers hard earned dollars! The time has come for them to realize they are not Nostradamus and simply manage the present system and stop gambling with our taxes!

*Ontario doesn’t offer rebates but the Federal Government grants $5,000 for the purchase of a new BEV