Intrigued by the many eco-warriors touting how wind and solar are cheaper generation sources then natural gas I decided to use Scott Luft’s (Cold Air) compilation of data for 2023 to calculate on a “simple” basis what each generation source actually cost us ratepayers/taxpayers to see if the claims made were even close to the truth. Below is a small sampling of what the claims were and who made them! Please note that four of them are registered “charities” and one is from the Federal Ministry of the Environment and Climate Change!

“While natural gas prices have skyrocketed in the last year and will remain volatile, wind and solar are now the cheapest form of new electricity generation and offer lower rates for the consumer.“

“Solar and wind power now cost a fraction of what power from gas-fired power plants or nuclear reactors costs. It is simply the lowest cost way to meet our growing electricity needs, and Ontario has tremendous solar and wind potential.”

“As we move to clean, renewable electricity, we also move to more affordable energy for households in Canada. This is in part because renewable electricity sources like wind and solar are now the cheapest forms of electricity in history.“

Government of Canada: Alberta: Clean electricity snapshot

“Renewable electricity projects such as solar and wind are cheaper than natural gas. Several studies are showing that in Canada a shift to net-zero electricity can support affordability and result in energy savings for households.“

Canadian Climate Institute “Clean power is cheap. Wind can now produce electricity at lower costs than natural gas-fired power in Alberta and Ontario. Solar power is already cheaper than electricity from gas in Alberta and is on track to be 16 per cent less expensive by the end of the decade.“

The foregoing quote is from CCI, a charity, where Rick Smith (formerly with Environmental Defence) is the President earning somewhere between $250,000 and $299,999 annually. CCI was a creation of Catherine McKenna when she was Minister of the Environment and Climate Change and handed them $20 million of our tax dollars for a five-year study period. CCI were recently (April 2023) handed another $30 million of our tax dollars by the Ministry of the Environment and Climate Change now headed up by Steven Guilbeault, even though the five-year period wasn’t finished!

Now, let’s have a look at the Annual Average Cost by Generator Source in 2023 in Ontario using Cold Air’s compilation to determine if any of the foregoing quotes are anywhere close to the truth:

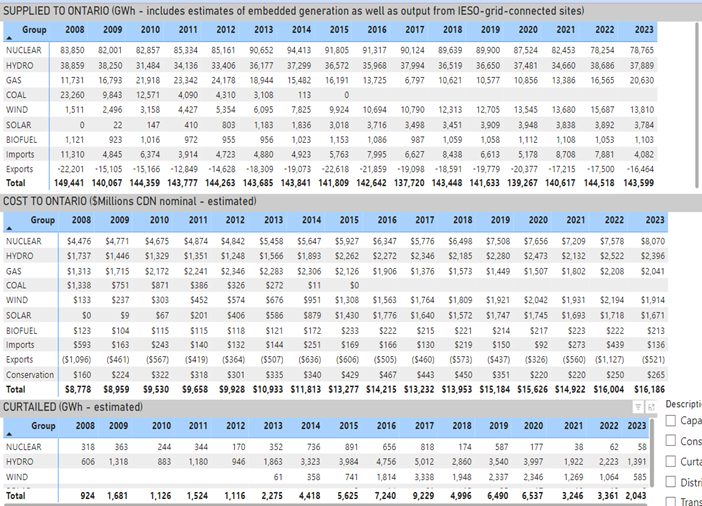

First let’s start with Cold Air’s post of IESO 2023 data by simply displaying his charts!

As is readily apparent from the above the first compilation contains the power generated by each of the generation sources in Ontario by GWh (Gigawatt hour) and the second compilation contains the costs of each generation source. That makes it relatively easy to calculate the average per kWh (kilowatt hour) cost for each source of power by simply dividing the costs by the GWh delivered. What we find is the following:

2023 Cost by Generation Source in Ontario

Generation GWh Cost Millions Cost per kWh

Nuclear 78,765 GWh $8,070. 10.2 cents

Hydro 37,889 GWh $2,396. 6.3 cents

Natural Gas 20,630 GWh $2,041. 9.9 cents

Wind 13,810 GWh $1,914. 13.8 cents

Solar 3,784 GWh $1,671. 44.1 cents

Biofuel 1,103 GWh $ 213. 19.3 cents

Conclusion:

The only generation source cheaper than natural gas generation in Ontario in 2023 was hydro whereas wind, solar and biofuel generation are much more expensive than hydro, natural gas or nuclear!

The time has come to defund the eco-warriors and tell them to do some basic math retraining. The foregoing might allow them to get a real job that won’t harm our economic well being and at the same time will save us some taxes and perhaps even lower our inflation rate along with our annual Federal deficit!

Oh yes, it will also keep our costs of electricity at reasonable and competitive levels while providing the rampable power needed to avoid blackouts!